There are various types of taxes that apply in Indonesia. One of them is a progressive tax for motor vehicle owners.

The existence of this tax is deliberately imposed to reduce the number of existing motorized vehicles and reduce the number of traffic jams that are common in urban areas.

What is the progressive tax rate and how is it calculated? Read more in the following description.

What is Progressive Vehicle Tax?

What is a progressive tax? A progressive tax is a tax rate imposed on motorized vehicle owners with a percentage based on the number of tax objects and the amount of the object's value.

A progressive tax is imposed for people who have more than one vehicle with the same type of vehicle, owner's name, and address. In other words, the more the number of vehicles owned, the greater the value of the vehicle tax that must be paid. This type of tax is often referred to as a multilevel tax.

So, if you have 2 motorbikes or cars, then this tiered tax can certainly apply. Likewise with the ownership of 4 cars with different names but the same residential address or combined in one Family Card (KK), then the second to fourth cars are subject to this tax.

Progressive taxes also apply to old vehicles that have been sold but have not been renamed and you already have a new vehicle. Therefore, before you decide to buy a new vehicle, be sure to immediately reverse the name of your old vehicle that has been sold.

Progressive tax does not apply if you have 1 car and 1 motorbike. In addition, TNI/Polri motorized vehicles, ambulances, hearses, public transportation, fire engines, government vehicles, and vehicles for social and religious institutions are not taxed at this level.

Also Read: Here's the Easy Way and Conditions for Transferring Motor Names

Legal Basis for Progressive Vehicle Tax

The existence of a progressive vehicle tax has been regulated in accordance with the applicable legal basis, namely Law Number 28 of 2009 concerning Regional Taxes and Regional Retribution (PDRD). The law reads:

"The motor vehicle tax rate policy is also aimed at reducing the level of congestion in urban areas by giving regional authorities the authority to apply progressive tax rates for second vehicle ownership and so on."

The existing progressive taxes are divided into 3 according to the type of ownership:

- Less than 4 Wheel Vehicles

- 4 Wheel Vehicle

- More than 4-wheeled vehicles

Also Read: The Latest, Easy, and Fast Ways and Terms of Paying Motorcycle Taxes!

Progressive Vehicle Tax Rates

The following details are regarding progressive car taxes and motorcycle progressive taxes in several provinces in Indonesia. It should be remembered that each province has a different level of the tax rate in accordance with the stipulated authorities and as long as this refers to Article 6 of Law Number 28 of 2009.

The contents contained in the article include:

- The first Motor Vehicle Tax (PKB) rate is a minimum of 1% and a maximum of 2%.

- Second and so on Motor Vehicle Tax (PKB) rates are as low as 2% and as high as 10%. Valid for car and motorbike owners.

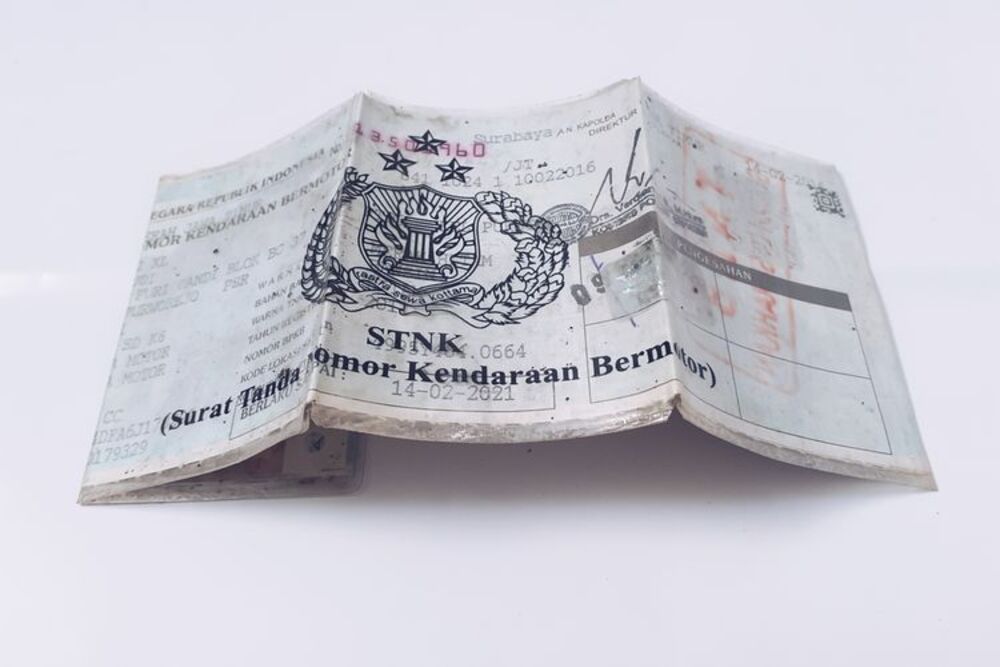

Image Source: BFI Finance Team

Progressive Tax Rates in DKI Jakarta

Based on DKI Jakarta Provincial Regulation No. 2 of 2015, the following is the amount of applicable tax.

| Order of Vehicle Ownership | Tax Rate (%) |

| First Vehicle | 2% |

| Second Vehicle | 2,5% |

| Third Vehicle | 3% |

| Fourth Vehicle | 3,5% |

| Fifth Vehicle | 4% |

| Sixth Vehicle | 4,5% |

| Seventh Vehicle | 5% |

| Eighth Vehicle | 5,5% |

| Ninth Vehicle | 6% |

| Tenth Vehicle | 6,5% |

| Eleventh Vehicle | 7% |

| Twelfth Vehicle | 7,5% |

| Thirteenth Vehicle | 8% |

| Fourteenth Vehicle | 8,5% |

| Fifteenth Vehicle | 9% |

| Sixteenth Vehicle | 9,5% |

| Seventeenth Vehicle | 10% |

Progressive Tax Rates in West Java

As for taxes in West Java, the details of the rates are as listed in the following table.

| Order of Vehicle Ownership | Tax Rate (%) |

| First Vehicle | 1,75% |

| Second Vehicle | 2,25% |

| Third Vehicle | 2,75% |

| Fourth Vehicle | 3,25% |

| Fifth Vehicle onwards | 3,75% |

Progressive Tax Rates in Central Java

For Central Java and its surroundings, the following tax rates apply.

| Order of Vehicle Ownership | Tax Rate (%) |

| First Vehicle | 1,5% |

| Second Vehicle | 2% |

| Third Vehicle | 2,5% |

| Fourth Vehicle | 3% |

| Fifth Vehicle onwards | Increase of 0.5% for Every Addition of Existing Vehicles (Highest 10%) |

Progressive Tax Rates in East Java

The East Java Provincial Government stipulates a graded tax in accordance with Regional Regulation (Perda) No. 9 of 2010 concerning Regional Taxes. The regulation states that the amount of tax that applies is as follows.

| Order of Vehicle Ownership | Tax Rate (%) |

| Second Vehicle | 2% |

| Third Vehicle | 2,5% |

| Fourth Vehicle | 3% |

| Fifth Vehicle onwards | 3,5% |

Progressive Tax Rates in Bali

Progressive tax in Bali is determined in accordance with the Bali Provincial Regulation No. 1 of 2011 concerning Regional Taxes with the amount of the tax rate as below.

| Order of Vehicle Ownership | Tax Rate (%) |

| First Vehicle | 1,5% |

| Second Vehicle | 2% |

| Third Vehicle | 2,5% |

| Fourth Vehicle | 3% |

| Fifth Vehicle onwards | Increase of 0.5% for Every Addition of Existing Vehicles (Highest 10%) |

Progressive Tax Rates in West Sumatra

The Provincial Government of West Sumatra (West Sumatra) imposes a tax for people who have more than one similar vehicle with various rates as below.

| Order of Vehicle Ownership | Tax Rate (%) |

| Second Vehicle | 2% |

| Third Vehicle | 2,5% |

| Fourth Vehicle onwards | 4% |

Progressive Tax Rates in South Sulawesi

Finally, the progressive tax rates that apply in South Sulawesi Province have details of the rates as attached in this table.

| Order of Vehicle Ownership | Tarif Pajak (%) |

| Second Vehicle | 2% |

| Third Vehicle | 2,25% |

| Fourth Vehicle | 2,5% |

| Fifth Vehicle onwards | 2,75% |

How to Calculate Progressive Vehicle Tax

Calculating progressive taxes is based on 4 important things

- Selling Value of Motorized Vehicles (NJKB)

- Value of Motorized Vehicle Tax (PKB)

- Progressive Tax Value

- Compulsory Road Traffic Accident Fund Contribution (SWDKLLJ)

The following is an example of a multilevel or progressive vehicle tax calculation to make it easier for you to calculate it.

For example, you have 2 cars and live in Jakarta. Both cars were purchased in the same year. The first car has a breakdown of taxes and other fees as below.

- Motor Vehicle Tax (PKB) at the STNK of IDR 2,700,000 and SWDKLLJ IDR 153,000

- Motor Vehicle Sales Value (NJKB) = (Rp. 2,700,000:2) X 100 = Rp. 135,000,000

If you want to find out how much the tax rate is, then the calculation is:

PKB: IDR 135,000,000 X 2% = IDR 2,700,000

SWDKLLJ: IDR 153,000

Progressive Tax Amount: IDR 2,700,000 + IDR 153,000 = IDR 2,853,000

So, the tax rate for your first car is IDR 2,853.00.

As for the second car, which has a price of IDR 120 million, the calculation is:

PKB: IDR 120,000,000 X 2.5% = IDR 3,000,000

SWDKLLJ: IDR 153,000

Progressive Tax Amount: IDR 3,000,000 + IDR 153,000 = IDR 3,153,000

From the results of the calculation above, the second vehicle tax is IDR 3,153,000.

The calculation method above applies to motorized vehicles, whether it's a car or a third, fourth, and so on a motorcycle. From these calculations, it can also be seen if the tax value will increase in line with the increase in motorized vehicles that you have.

Quick Liquid Fund Solutions

Need fast funds but the motor vehicle hasn't returned its name or the tax is dead? BFI Finance is ready to help you!

We can help you with your various needs and financial needs. Starting from venture capital, educational expenses, lifestyle, and others.

You can access complete information via the web page below.

Submission Information BPKB Motor Collateral Loan

Submission Information BPKB Car Collateral Loans

Submission Information Home Certificate Collateral Loans

Sobat BFI, this is a review regarding progressive vehicle tax starting from the definition to how to calculate it. Make sure to always comply with existing rules, one of which is paying taxes on time. Hopefully this information can be useful and make it easier for you.

Get the latest interesting information every Monday-Friday on the BFI Blog.