A purchase invoice is often considered trivial, even though this document is very important every time you buy goods or services. Not only does it serve as proof of payment, but it also helps record transactions, protect your legal position, and simplify the preparation of financial reports.

Want to know the complete functions, benefits, and an easy way to create a purchase invoice? Read this article until the end and discover a practical way to manage your business documents without hassle!

What Is a Purchase Invoice?

A purchase invoice is proof of a transaction received by the buyer from the seller when purchasing goods or services. This document shows that the goods or services have been received and must be recorded in financial bookkeeping. It is similar to a sales invoice, with the difference lying only in the recording perspective.

A sales invoice is created by the seller, while the buyer recognizes it as a purchase invoice. For example, when you place an order, the supplier issues a sales invoice. Once the goods are received, that document becomes a purchase invoice for you. Purchase invoices are essential to ensure that every transaction is properly recorded and legally valid.

Benefits of a Purchase Invoice

In running a business, every transaction needs to be recorded neatly. A purchase invoice serves as a document that makes this process easier. Here are the benefits of a purchase invoice for your business:

1. Physical Proof of Transaction

One of the main advantages of having a purchase invoice is obtaining tangible proof of every transaction. This document records details of the goods and their prices, making it an important reference for both buyers and sellers.

2. Clear Billing Information

Another benefit of a purchase invoice is that it provides clear information about the billing amount. With detailed breakdowns, you can immediately see how much needs to be paid for ordered goods, making the payment process easier and more controlled.

3. Official Document for Financial Records

A purchase invoice also functions as an official document recognized in accounting. It serves as valid proof of transactions, helps record company finances, and provides information related to the purchase of goods.

4. Basis for Consumer Claims

Purchase invoices are also useful as evidence for consumers if issues arise with an order. For example, if the goods received do not meet expectations, this document can be used as a basis for requesting a return or refund.

5. Shows Company Inventory Levels

Another benefit of a purchase invoice is that it helps companies monitor available inventory. By recording every transaction, businesses can more easily control stock levels and determine when additional purchases are needed.

Components of a Purchase Invoice

If you have seen a sales invoice before, reading a purchase invoice will not be confusing. Essentially, both are similar, differing only in who records the transaction. Typically, a purchase invoice includes the following key elements:

-

Seller or company information, such as logo, name, address, and phone number

-

Buyer identity and address

-

Transaction number and invoice date

-

Details of goods or services purchased

-

Total payment, including subtotal and taxes

-

Signatures of the cashier and buyer as proof of approval

How to Create a Purchase Invoice

Creating a purchase invoice is actually quite simple if you follow the right steps. Here is how to do it:

1. Prepare Seller and Buyer Information

Make sure to include complete information about both the seller and the buyer, such as company name, address, and contact number. This data helps transactions be easily identified and tracked if needed.

2. Include Invoice Number and Date

Each purchase invoice should have a unique number and a creation date. This makes the document easier to organize, search for, and helps companies track payment schedules more systematically.

3. Detail the Goods or Services Purchased

Record all goods or services purchased, including product names, specifications, quantities, unit prices, and total prices for each item. With this level of detail, transactions can be reviewed clearly and accurately.

4. Calculate Subtotal and Total Payment

Calculate the total cost of all goods or services, and don’t forget to add taxes such as VAT or other additional charges if applicable. Clearly state the total amount payable to avoid confusion.

5. Specify Payment Terms and Methods

Clearly state the available payment methods, such as cash or bank transfer, including the seller’s bank account number. Also include the payment deadline, for example within 30 days, so buyers are aware of the due date.

6. Add Signature and Stamp

To make the purchase invoice official, have it signed by the seller or their representative, and add a company stamp if necessary. This ensures the invoice is legally valid and can be used as official proof of the transaction.

Example of a Purchase Invoice

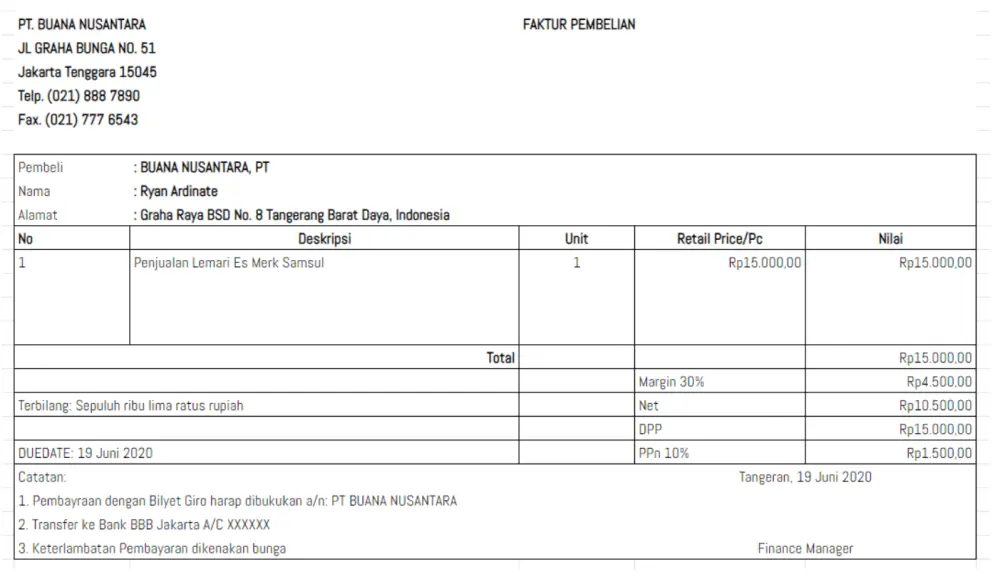

To make it easier to understand how to create a purchase invoice, here is an example of a purchase invoice. This example can be used as a reference when preparing your own transaction documents.

The image above shows a sample purchase invoice containing basic information such as seller and buyer identities, details of purchased goods or services, prices, taxes, total payment, as well as notes and payment methods.

That concludes the explanation of purchase invoices, from their definition to examples. By understanding this, you can more easily record, control, and verify purchase transactions, ensuring your business finances remain neat and well organized.

In practice, even if a business already has well-organized transaction records, sudden needs—such as purchasing additional stock, repairing equipment, or covering unexpected operational expenses—can still arise. To handle such situations, having access to fast and flexible financing solutions is crucial.

BFI Finance is here to provide convenient financing solutions for business needs as well as personal requirements. With collateral such as a Motorcycle BPKB, Car BPKB, or Property Certificate (House/Shophouse/Office), financing can be applied for and tailored to your business or personal financial conditions.

The process is transparent and secure, supported by more than 40 years of experience and direct supervision by the OJK (Financial Services Authority). Managing business capital and finances becomes more controlled because #SelaluAdaJalan with BFI Finance.